Flutter vs ReactNative:Comparison

Web & Mobile Development

Read moreDrive innovation and foster business growth with a custom-made fintech solution

Transform your idea into a digital masterpiece with all-in-one fintech app development services. We take care of your project from start to finish: beginning with strategy and market research, through exceptional UX and UI design, to app development and support. Our custom fintech applications mix cutting-edge technology with data-based research to bring solutions that work for your business.

With 10+ years of experience in the field, we know the challenges and requirements of the fintech industry. See what we can do for you.

Miquido meets the demands of modern banking. Whether you need a client-centered product or a solution to facilitate your business operations, we mix cutting-edge technology with years of our expertise in the field to bring you the best banking solution possible. Change the way people do banking by creating your custom digital banking platform from scratch. Craft user-focused applications such as digital wallets or mobile banking apps with our mobile banking development services. Implement custom Machine Learning features and Data Science solutions to boost your product’s usability, or increase your revenue with long-term data-based strategy.

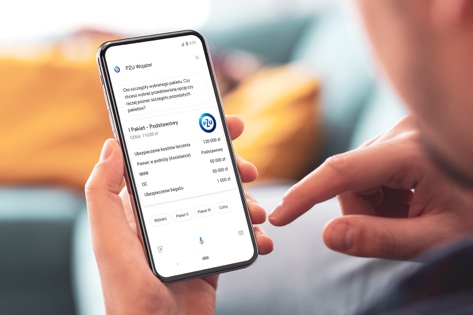

The insurtech sector is all about top-notch customer service. There are several ways to gain the trust of your customers. You can go for an excellent, user-centered mobile application or choose a dedicated solution to smoothen things out on the business side. We can take care of both. Our team specialises in custom insurance application development, done with human-centered design in mind, and answering business challenges at the same time. We implement Artificial Intelligence solutions for insurance, such as voice assistants and chatbots, to help you gain a competitive edge and boost customer service standards.

Read about insurance app development

Fintech is an industry like no other. Top-level security is crucial when lots of sensitive data is involved and large sums of money are processed. Impeccable performance is a must, especially in stock trading applications, when time is of the essence. A user-centered approach and high usability come as a priority when the solution must serve thousands of users. Our team delivers tailored financial applications such as web and mobile trading platforms, investment applications, stock exchange apps or advanced savings calculators, built to meet business needs and maintain top-notch industry standards.

Need your idea verified fast?

Why should you develop your app with Miquido? Our experience in fintech app development speaks for itself—read on to see how we’ve built a reputation as a trusted technology partner.

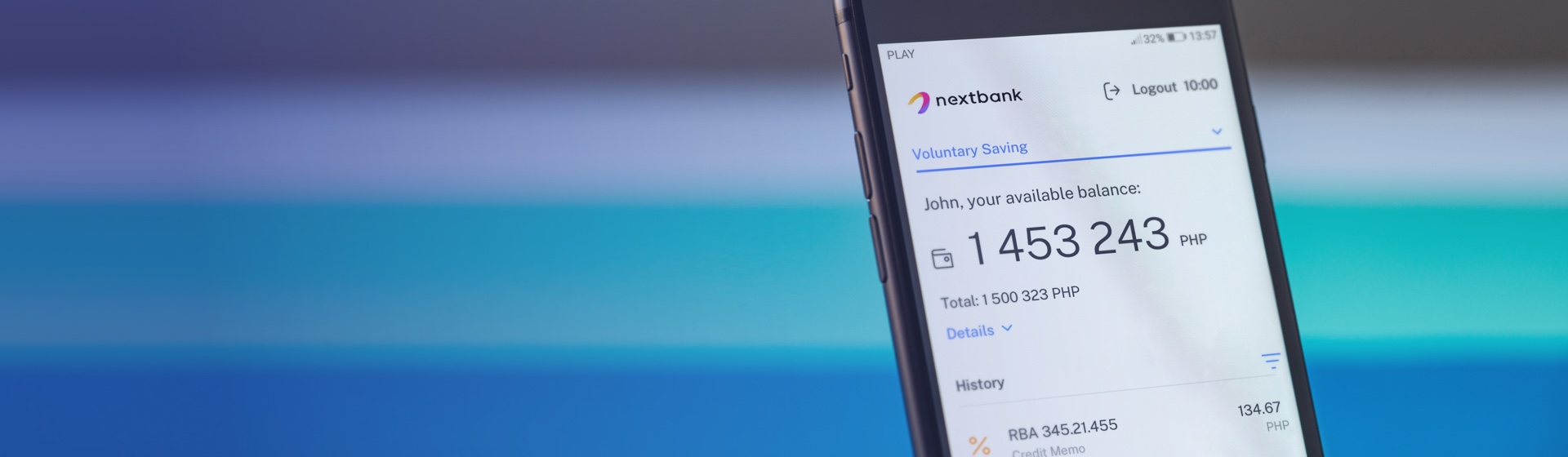

We pride ourselves on excellent applications recognised worldwide. Our fintech applications for Nextbank have been recognised by Singapore Fintech Festival 3 years in a row. Our portfolio of 100+ projects has granted us recognition from prestigious organisations such as Google I/O, UK App Awards or Mobile Trends Awards. We are one of 50 Google-certified software houses globally, which marks excellence in software development and a customer-focused attitude.

You don’t need to juggle multiple teams and vendors to get a fully-functional digital product. From ideation, product strategy, and prototyping, through UX and UI design, to development and maintenance, we take care of your project from start to finish, making sure it turns into a huge success. Transparency and seamless communication are our key values that help you feel in control throughout the entire process.

We want to see your app succeed as much as you do. That’s why there are no one-size-fits-all solutions here. We always study your business goals, needs and expectations carefully, not only to deliver the best solution possible, but also to advise you on the right tech stack or product strategy. Whatever phase your project is in, we always keep the bigger picture in mind, making sure the approach we choose fits the bill perfectly.

Finance, banking and insurance are known as highly competitive sectors. There are a lot of factors in play if you wish to stay one step ahead of your competitors, and technology is one of them. We always take time to verify your idea and advise you on the tech solutions that will work best in your case. We also offer custom AI-based features and Data Science solutions to make sure your product reaches its full potential.

You don’t want to put your project in inexperienced hands. Over 10 years of development for the banking, insurance and finance industries has taught us all there is to know about fintech applications. We partner with fintech leaders worldwide such as AXA, BNP Paribas or Aviva, as well as startups like Paymaya and Nextbank. Thanks to that, we’ve gained hands-on experience that gives us the advantage of seeing the bigger picture and understanding what the industry demands.

Struggling to find a solution that fits your expectations perfectly? Choose custom app development. We build our fintech solutions from scratch, starting with deep market research, gathering data-based insights, and studying your needs and business goals carefully to offer you a solution that fits like a glove.

What is there to gain? Recognisable design to help you stand out and build a strong brand. Scalability and flexibility that lets you adjust your product as your business grows. No unnecessary features, but a product that is tailor-made for you. Development schedule and budget adjusted to your business plan. Full application support and maintenance. And that’s just to name a few!

Thinking about launching your own fintech app? Browse the questions our clients often ask and find out all you need to know about our fintech app development services. Or simply shoot us an email!

A financial app, also called a fintech app, is a software solution developed with the aim of managing and optimising various financial processes. Those can include digital banking, personalised money management, market investments, insurance activities, and many other different operations. The popularity of financial apps has risen significantly in recent years as mobile banking has become the new norm, and the fintech app industry is only predicted to continue to expand in the near future.

The cost of your fintech app can vary depending on numerous factors, some of which will have more of an impact on the final price than others. The basic questions that will help to estimate the cost of your project are:

Having that in mind, the development of a fully functional minimum viable product takes about three months. If we look at average rates for leading software houses in Central Europe, without taking things like design, project management, and app maintenance into account, you can easily estimate that the cost of such MVP developed for one platform (Android or iOS) will be close to around 30 000 GBP.

Unsure of what your financial app features should be? Consult us; our experts will advise you on what’s best for your unique product idea.

The most commonly used language when it comes to banking app development is Java, which has been the preferred option by the fintech industry for over two decades. Mobile banking apps for Android are most often developed using either Java or Kotlin, which is considered to be the more modern solution, while Swift is used for iOS.

As with most such questions, analyzing a company’s particular business needs is the key to a clear answer. There are many companies that would be perfectly satisfied with an out of the box solution. However, if you’re looking for a unique, scalable product, then custom app development is the way to go.

Pre-made fintech apps have one major asset on their side, which is a significantly lower cost. However, you have to take into account that pre-made solutions come with major drawbacks when it comes to scalability and customization. And when it comes to additional costs along the way, a custom solution may actually prove to be the cheaper choice in the long run. Custom app development allows you to stay ahead of competition as it offers the possibility of making various changes and adding multiple new features.

First things first, you should have a clear understanding of the problem that your app is supposed to solve. The key to a successful digital product is pinpointing current user needs and knowing exactly how to respond to them. The first step on this journey should focus on answering the question: is there any demand for what I’m offering?

Secondly, you should get to know your potential user base and whether or not they’re likely to use the app. Thorough background research is essential in order to verify a product idea. Try to estimate the number of users your app is likely to have and find out if there are similar options already on the market. If so, think about the benefits of your app that would make users switch to a new solution. Ideally, you’d have a list of features for your new app and be able to compare them with what the competitors have in store. To assist you in achieving your business goals, at Miquido we offer a range of Product Ideation & Strategy services that will help you to refine your app idea and make sure you’re on the right track.

Of course, the real test comes once the app goes live. There’s always a risk, and that’s why we recommend starting with a minimum viable product in order to gain real insight into your users’ needs and receive the much needed feedback on your app idea.

Throughout recent years, AI has helped to automate and optimise many banking processes. For one, Artificial Intelligence plays a huge role in ensuring transaction safety and preventing credit card fraud thanks to thorough AI-based customer behaviour analysis. Banks are also able to perform loan risk assessments more efficiently by using AI to examine the data about potential loan recipients and pinpoint the associated risks. A massive benefit of using AI in banking comes in the form of virtual assistants and chatbots that can significantly improve customer service while also reducing the need for phone calls and personal visits at the bank. Thanks to AI, banks can also upgrade customer experience by recommending services to the users based on their behaviour.

The most obvious answer to this question requires only one word: personalization. Using AI to analyze and process enormous amounts of data can help you better understand your users and give them a personalised experience, which makes for better user engagement and loyalty to your digital product. It is also worth noting that the use of AI powered speech recognition technology is currently on the rise, and is only expected to grow in the upcoming years. Taking into account the recent tech trends, equipping your app with AI features may be crucial when it comes to staying ahead of the competition.

Web & Mobile Development

Read more

Business Strategy

Read more

Business Strategy

Web & Mobile Development

Read more

Hi, I’m Krzysztof, Head of Sales at Miquido. Fill in the form to the right and we’ll get in touch soon!

The controller of your personal data is Miquido sp. z ograniczoną odpowiedzialnością sp.k. with its registered office in Krakow, ul. Zabłocie 43a, 30-701 Kraków. We process the above information in order to answer your questions, contact you and conduct business communication, and if you tick the checkbox, to send you messages containing commercial, business and marketing materials.

The basis for the processing of your data is your consent and Miquido’s legitimate interest.You can unsubscribe from the marketing communications at any time. You also have the right to access data, the right to request rectification, deletion or limitation of their processing, data transfer, the right to object, as well as the right to lodge a complaint to the supervisory body. Full information about processing of personal data can be found in the Privacy Policy