How Long Does It Take to Build an App? Development T…

Business strategy

Read moreAchieve the synergy between the innovation and the industry-specific demands

Let’s work together

Craft a solid banking app with a software house that knows the challenges of the industry. With over a decade in the business, we’ve created finance solutions that have boosted company ROIs and ensured convenience for their clients. Whether you need a custom banking platform created from scratch or a solution to improve your business operations – we’ve got the expertise to make it happen.

Ready to refine your business with a modern banking app? See why we should be the ones to build it!

We know we make outstanding products, but you don’t have to take our word for it. Our apps have been recognised worldwide, and our portfolio of over 100 projects has been granted awards from established organisations such as The UK App Awards, Mobile Trends Awards, or Singapore Fintech Awards. We’ve also been recognised as a Google-certified software house, so you can be sure that your project is in the right hands.

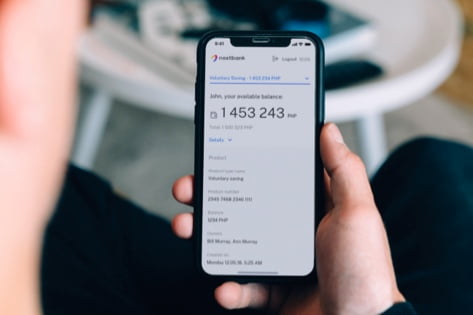

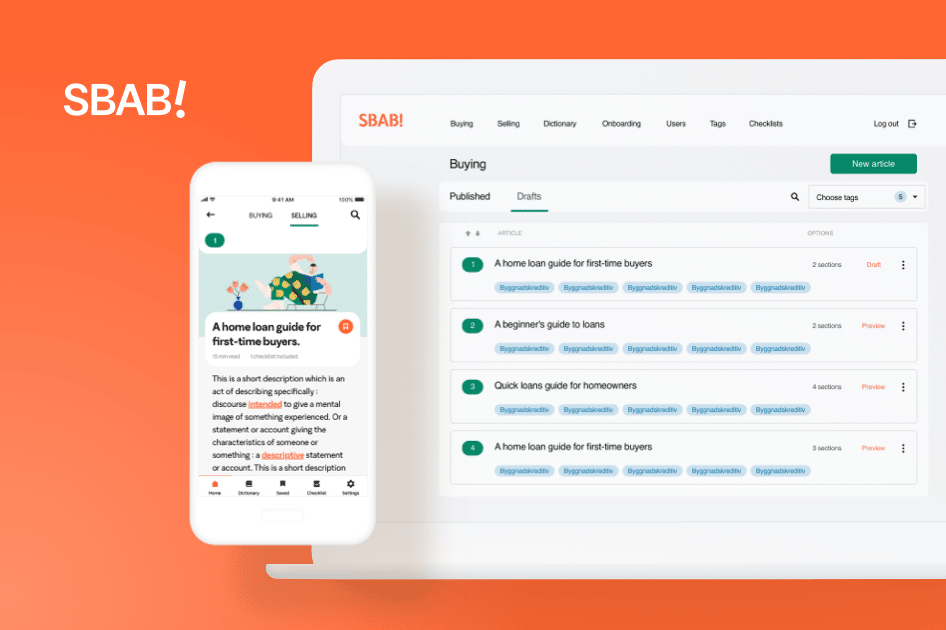

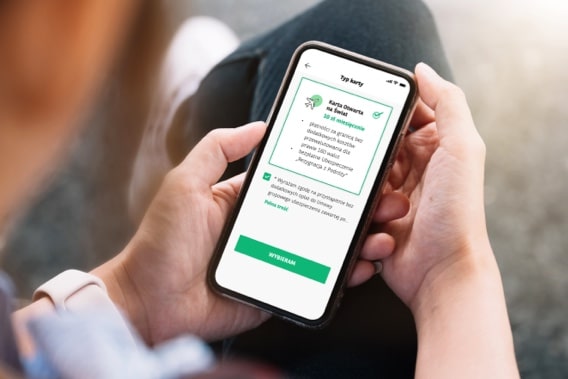

Choose a team of experts that knows what it takes to build a winning solution for digital banking. Over the years, we’ve completed projects for the industry’s front runners, such as BNP Paribas, SBAB or Nextbank. Those experiences helped us understand just how competitive the financial industry can be, and how hard it is to stay ahead of the game. We’ve helped with complex projects as well as simple solutions, and we’ll be happy to do it again!

There’s no need to engage multiple vendors just to finish one project. With Miquido, you have the ability to do it all in one place: from ideation and strategy, through UX/UI design and development, all the way to maintenance and further product growth. Whatever you need, our team of experienced professionals will help to find the right solution for your business.

First and foremost, your banking application needs to be secure, but functionality and innovation also play an important role when aiming for success on the market. While evaluating your idea, we’ll advise you on the technology that suits your project and business best, and our AI, Machine Learning and Data Science services are there to make sure your product leaves the competitors far behind.

Need your idea verified fast?

An app advising home buyers on mortgage loans

Have some questions about banking app development? Browse our FAQ section and search for your answers or contact us to learn even more.

The most common types of banking services available through mobile apps are:

IT has been revolutionising the way banking works for years, with the most current trend being banking for mobile. Be it through the use of chatbots for better customer service, digital wallets, account inquiries, or simple digital transactions, the main goal is to optimise the experience for both the institutions and their customers.

A core banking software is defined as a backend system that makes it possible to access an account and perform banking transactions. A system like that will usually include deposit, as well as credit and loan processing and various CRM functions.

The main types of banking software apps are:

Business strategy

Read more

Artificial Intelligence

Read more

Artificial Intelligence

Business strategy

Read more

Hi, I’m Krzysztof, Account Executive at Miquido. Fill in the form to the right and I’ll get in touch with you soon!

The controller of your personal data is Miquido sp. z ograniczoną odpowiedzialnością sp.k. with its registered office in Krakow, ul. Zabłocie 43a, 30-701 Kraków. We process the above information in order to answer your questions, contact you and conduct business communication, and if you tick the checkbox, to send you messages containing commercial, business and marketing materials.

The basis for the processing of your data is your consent and Miquido’s legitimate interest.You can unsubscribe from the marketing communications at any time. You also have the right to access data, the right to request rectification, deletion or limitation of their processing, data transfer, the right to object, as well as the right to lodge a complaint to the supervisory body. Full information about processing of personal data can be found in the Privacy Policy